Who should think about critical illness insurance?

The answer is, most of us.

It’s not fun to think about how your life might change if you were diagnosed with a critical illness. Or even, if your partner or child was diagnosed with a critical illness. But it’s realistic and responsible to be prepared. You likely know at least one person in your immediate or extended family or circle of friends who’s had cancer, a heart attack or stroke, don’t you? It makes you think.

Health risks are real and random, no matter who you are. Every four minutes a Canadian is diagnosed with cancer and more than 400,000 Canadians are currently living with the long-term effects of a stroke.

Your most important asset isn’t your home or your car or any of the other things you may buy insurance for (extended warranty on your cell phone anyone ???) Your most important asset is your ability to earn an income.

If you have family, loved ones, or a home or business to take care of, you should take a look at the benefits critical illness insurance can offer.

Could you…

- Pay all of your bills and maintain your standard of living?

- Keep your long-term financial goals and plans in tact – your retirement, saving for a child’s education, paying your mortgage or saving for a house?

- Have options for yourself or the people you care about, allowing time and financial help to make decisions that are right for you?

- Pay for medical costs not covered by the government or employee health plans?

- Be away from your business and keep things going?

- Provide one less thing to worry about during a difficult time?

In the newspaper’s , on almost a daily basis you see article’s about Canadian’s who have been diagnosed with critical conditions and are struggling to pay for the financial costs and loss of income associated with these conditions. Too many people have had to start crowdfunding campaigns to get family , friends and strangers to help pay for the cost of treatments, travel, or just living. In all of these cases, if they had had critical illness insurance, they would not have the added stress of asking for financial support.

5 Things you may be wondering about critical illness insurance

If you’re not familiar with critical illness insurance and how it work, here is some information to get you started:

1. What does critical illness insurance cover?

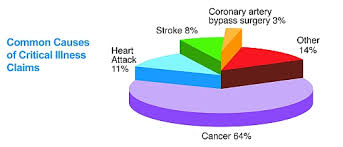

A critical illness is a condition that could prevent you from working or carrying on your regular routine. Each insurance company covers different conditions. Certain cancers, heart attack and stroke are the most commonly covered conditions.

2. What can critical illness insurance do for me?

Critical illness insurance can give you a lump-sum payment to use however you want. You can also customize your policy to get some or all of your money back if you don’t have an illness.

3. Is critical illness insurance expensive?

Everyone’s idea of what’s expensive and what’s not is different based on their personal financial situation. Critical illness insurance can be a lot less expensive than paying out of pocket for medical expenses that aren’t covered by the government health plan or your employee benefits. It can also be a lot less costly than having to worry about paying your regular bills (mortgage, car payments, utilities, etc.) while you or your spouse is in treatments or recovery. For instance, a non-smoking 35 year old man will pay between $54 and $59 a month for $50,000 of critical illness insurance coverage.

4. Will I get the money if I make a claim?

If you are diagnosed with a covered critical condition and survive the waiting period (typically 30 days), you’ll receive a lump-sum payment equal to your coverage amount. That money is yours to spend however you like. Cover living expenses, pay for medication that isn’t covered by the government health plan, or even take a trip when you’re well.

5. Is critical illness insurance hard to get?

Each insurance company has different qualifications , but most individuals can get critical illness insurance of some kind. You will be asked a variety of questions , including details about your family medical history and may also be required to complete some medical tests.

Another great resource to get information and to complete a quiz that assesses your specific need for critical illness is the following website : www.criticaluncovered.ca . It also lets you look specifically at your chances of being critically ill prior to age 65 and the average financial cost associated with being critically ill.

If you would like to get more information and specific costs and pricing, please call or email Glenn Davis at : glenn@propathinsurance.com or by phone at : 647-367-9475 Ext. 1