Is your company providing less benefits to the owner and your key employees than the rest of your staff?

It happens all the time. Your hard work and efforts are paying off in your business. You want to reward yourself and your employees by implementing an employee benefits plan. One of the biggest mistakes companies make is providing a worse disability program to top employees compared to the others. They don’t even realize they are doing it.

An employee benefits plan is an attractive benefit that makes sense for a business owner to implement. It increases retention and rewards your employees by providing valuable coverage for them, at a known fixed cost for your business. Disability Insurance is one of the most important benefits you can provide to your employees.

Consider the impact to your business if your key employees were unable to work

If a health problem meant they couldn’t work, it could significantly impact your business, not to mention personal and financial repercussions for these individuals and their families.

While Disability Insurance is an extremely valuable benefit, it is important to realize that for owners and key employees, the amount of coverage they may be receiving could end up being much less than the rest of the employees in your organization. The end result is that the most important people in the company are getting the least amount of benefit.

Let’s look at an example:

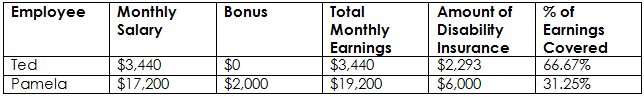

Ted is one of your employees. He works in Data Entry and makes $20 per hour. You have put in place an employee benefits program which includes disability insurance. In the event Ted cannot work, his disability insurance would pay him a benefit of approximately 66% of his earnings.

Pamela is another one of your employees. She is responsible for bringing in the business and is key to the ongoing success of your organization. She is paid $100 per hour plus is eligible for an annual bonus of $24,000 (or $2,000 per month). In the event that Pamela cannot work, she would only receive approximately 31% of her earnings.

Does this seem fair?

Most traditional disability benefits set a certain cap on how much an employee would make during a disability. This leaves top earners under-insured versus the other employees in the company.

Traditional disability benefits only insure salaries. Most owners and key employees are also paid through bonus’s or dividends so the actual % of earnings paid out becomes even less.

The Numbers:

When Disability Insurance is set up under a Group Insurance Plan a formula is used in order to calculate how much benefit is payable in the event of a disability.

The formula’s used do differ amongst companies, but most would use one similar to this:

66.67% of monthly earnings up to an overall benefit maximum of $6,000.

Let’s look at how this formula compares between the example of Ted and Pamela above.

As you can see with the above chart, even though it appears that the formula should cover everyone equally , the overall maximum and the type of earnings that are covered have a huge impact on the amount of earnings that are insured.

What is the solution?

A business can set up an Executive Disability Plan which can be set up completely separate from a group benefits plan or be added as a top-up to your plan.

An Executive Disability plan will insure a variety of earnings including salary, bonus’s, and dividend’s. It also offers a much higher limit to those on the plan so that their benefits match their earnings. This plan can even be set up to offer a refund of premium, so if your key employees do not make a claim, you can benefit.

Other advantages of using an executive disability program:

- Premiums can be paid by the business, and are considered a tax-deductible business expense.

- Premiums are not considered taxable employee benefits when the plan qualifies as a group sickness or accident insurance (GSAI) for tax purposes

- Policies may qualify for premium reductions

- Helps attract, retain and reward the employees that are most valuable to the company

- Control – the company maintains control of the arrangement, providing coverage to your key employees and managing the expense through your business.

- Flexibility – coverage for each class of covered employees can be customized based on needs and budget.

If you are interested in reviewing your current Disability benefits offered through your group plan or would like more information on an Executive Disability Program, we are happy to set up a consultation with you.